|

STRATEGIC IMPLICATIONS OF 2007

STRATEGIC IMPLICATIONS OF 2007

During the year that is drawing to a close our industry experienced several dramatic events and trends, some for the first time and some as a déjà vu. It's time we should seriously contemplate these major events and their strategic impact on our business.

Here's what I observe:

The margin is "marginally" under our control

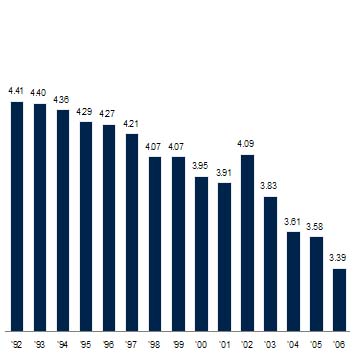

The past five years showed us yet again that regardless to deposit and loan mix, our margin is generally determined by market forces. While we experience expansion and contractions related to the slope of the yield curve as well as our deposit mix, recent years have also shown us that DDAs, while beautiful in their zero cost, still bear a fix price (0%), which hurts most those banks that have successfully built their DDA balances. We have also seen that the unprecedented flatness of the yield curve, whose duration has exceeded anything in memory, compressed bank margins even further. Last, the past 15 years show us that the margin is exhibiting a secular shrinking trend.

I believe there is no way around it. We can tweak around the edges, but not buck this secular trend. The implications are profound, since the majority of this newsletter's readers earn the bulk of their income, often north of 75%, through margin income. Mega-banks are outperforming community banks for the second year running

For years and years, mid-size banks outperformed every size segment of our industry, from the small banks to the large ones. This trend has been reversed in 2006 and 2007, with large banks outperforming the community banks despite a severe hit on their margins, primarily thanks for major improvements in efficiency and far less dependency on margin income. Customers are changing their behavior regarding payments, shifting to instruments we have abdicated or lost our leadership position

The payments business, a major factor in bank earnings, is being disintermediated from us as we speak. With Capital One de-coupling the debit card from t he checking account, and others following suit, and with credit card business (which accounts for 48% of all payments income) dominated by mono-lines (albeit, now bank owned), we see the business slipping between our fingers. The evaporating secondary markets.

Never before have we seen a thriving, robust secondary market in a bank asset be open for business at 8am and completely shut down that same afternoon. Liquidity was siphoned out of the sub-prime market before we could say "Alt-A", and this huge market closed on a dime.

These are but four of the many seismic events that have taken place and are still unfolding this year. The implications are profound.

The question needs to be asked: What are the industry's greatest assets and how can we leverage them best to continue EPS growth and optimize future earnings. Ask yourself:

- Is your capital invested where it will yield you the most earnings and franchise value?

- Are you effectively protecting and building your core business and customer bases?

- Can you afford not to play in certain parts of the business, say credit cards, remote capture etc.?

- Do you need to and are you prepared to diversify your income streams beyond the margin and suffer the short-term earnings depression that typically accompanies start-up operations?

- Can you afford to be the hedgehog if your core business definition might resemble the railroads?

2008 is going to be a tough year. Use the opportunity to strategically review your business and develop a discipline around your business alignment, definition and investment. Get back to the basics of aligning cost against revenue and ensuring revenue is growing faster. Select expansion into businesses that support your customer base and anchor them further into your bank, and pass all new business initiatives through this relevance screen. Consider how to solidify your customers' loyalty to your institution by putting yourself in their shoes and giving them compelling reasons to do more business with you, well beyond the George Foreman Grill and the Tool-bench.

2008 is going to be a tough year. Take advantage of it to take stock of your business and make the investments necessary to combat and capitalize upon the trends identified above: secular margin compression; threats to the core payments business income; the resurgence of the value of the balance sheet lender; etc.

|