|

Upcoming Forums:

BSA-Fraud

- Oct 17 - 18, 24 - TBD,

[Register] - Apr 10 - 11, 25 - TBD,

[Register]

Business Banking

- Jun 6 - 7, 24 - Charleston, SC

[Register] [Agenda] - Dec 9 - 10, 24 - TBD,

[Register]

Call Center

- Sep 19 - 20, 24 - TBD,

[Register] - Mar 27 - 28, 25 - TBD,

[Register]

CCO

- Apr 29 - 30, 24 - Scottsdale, AZ

[Register] [Agenda] - Oct 21 - 22, 24 - TBD,

[Register]

CEO

- Jun 2 - 4, 24 - Charleston, SC

[Register] [Agenda] - Sep 8 - 10, 24 - TBD,

[Register]

CFO

- Sep 5 - 6, 24 - Denver, CO

[Register] [Agenda] - Jan 30 - 31, 25 - TBD,

[Register]

CIO

- May 30 - 31, 24 - Scottsdale, AZ

[Register] [Agenda] - Dec 12 - 13, 24 - TBD,

[Register]

Commercial Banking

- May 6 - 7, 24 - Boston, MA

[Register] [Agenda] - Oct 31 - 1, 24 - TBD,

[Register]

Digital

- Sep 26 - 27, 24 - TBD,

[Register] - Apr 3 - 4, 25 - TBD,

[Register]

ERM

- May 23 - 24, 24 - Denver, CO

[Register] [Agenda] - Nov 18 - 19, 24 - TBD,

[Register]

HR Director

- Sep 30 - 1, 24 - TBD,

[Register] - Apr 7 - 7, 25 - TBD,

[Register]

Marketing

- Sep 18 - 18, 24 - TBD,

[Register] [Agenda] - Mar 26 - 26, 25 - TBD,

[Register]

Operations

- Sep 23 - 24, 24 - TBD,

[Register] - Mar 31 - 1, 25 - TBD,

[Register]

Payments - Forums

- Jun 10 - 11, 24 - TBD,

[Register] [Agenda] - Jan 27 - 28, 25 - TBD,

[Register]

Retail Banking

- Sep 16 - 17, 24 - TBD,

[Register] - Mar 24 - 25, 25 - TBD,

[Register]

Third Party Risk

- Jan 23 - 24, 25 - TBD,

[Register]

Treasury Management

- May 2 - 3, 24 - Scottsdale, AZ

[Register] [Agenda] - Oct 28 - 29, 24 - TBD,

[Register]

Wealth Management

- Sep 12 - 13, 24 - Santa Fe, NM

[Register] [Agenda] - Feb 3 - 4, 25 - TBD,

[Register]

BirdsEye View

teaching our employees how we make moneySecond quarter earnings season is wrapping up. Anecdotally it looks to me like there's a brighter line being drawn between those who are in a world of hurt due to credit woes, and everyone else. It seems as if 75% of the reports are well below estimates, almost exclusively due to credit deterioration in its various manifestations, and the rest are at or beating estimates, almost exclusively on solid credit quality and revenue growth. We'll know more in a couple of weeks.

Dan Wagner of St. Louis wrote:

"Agree with your "Midyear Review". I want to

offer an additional item as mentioned while meeting with a bank CEO

and CFO yesterday here in St. Louis (small bank, about $450M in

assets, with about $12M in BOLI). When discussing the macro

environment, the CEO said that Washington is saying that banks need

to start lending again, but he said that the examiners are looking

through the loan portfolio like a hawk. He said that the

examiners "are making it tough to make a loan". They

don't have a lot of problems (at least compared to some peers) in

the loan portfolio; about 1.4% of loans are nonperforming and they do

a really good job of knowing their customers (helping to avoid

major problems in the commercial loan portfolio) and building

relationships".

On the kid front: We're back at

home from Bhutan and Bali watching Arik practice for junior varsity

football. He's getting banged up pretty much but he loves it.

Guy, Dick and I spent a weekend in Sedona. It was a cool 110F

but we had a fabulous time anyway. If you find yourself out

that way, don't miss the Silver saddle dining room at the Cowboy

Club. Their buffalo short ribs, Elk tenderloin and cactus fries

are superb, not to mention that lightly whipped cream with the

chocolate cake they serve. Asi, the second oldest, is getting

married soon in Atlanta, where he's practicing as a plastic surgeon.

Liat is getting acclimated in Bhutan and we have been sending her

beef jerky and canned foods to make sure she's well fed and stocked

up on proteins... She has a great blog on her adventures:

http://thepursuitofgnh.blogspot.com. Paul is having a blast in New

York working this summer at Astoria Federal, and Gil is working at

UCLA and taking Econ courses. It's a full time job to see them

all, but it's a labor of love :)

The article

below is on a topic that few pay attention to, and I consider central

to effective bank performance and team building. Let me know

your thoughts.

Have a fabulous

end-of-July,

Anat

Article

synopsis : Teaching our employees how banks make money is the

best way to motivate them to the the right thing for shareholders,

customers and employees alike.

TEACHING

OUR EMPLOYEES HOW WE MAKE MONEY

Too often we find our employees

busy transferring wealth from shareholders to customers. They

diligently move funds from interest free to interest-bearing

accounts, waive all sorts of fees and give customers rate

exceptions. Many executives find this behavior puzzling.

I find it perfectly rational. Our employees want to do the

right thing; they just don't know what it is.

My

banking years taught me one clear lesson: most bank employees have no

clue how banks make money. Many believe the most

profitable product we have is CDs. Otherwise, why would we be

advertising it?

In addition, many employees

strongly feel that, as individuals, they can have no impact on the

company's financial performance, and, therefore, a small digression

such as fee waiver is insignificant in the great scheme of

things.

I have found that employees are, by and

large, perfectly capable of understanding the rudimentary

profitability dynamics of our business. The more they know

about our profitability, the more likely they are to make the right

decision for all three of their major constituencies - the

shareholders, customers and fellow employees.

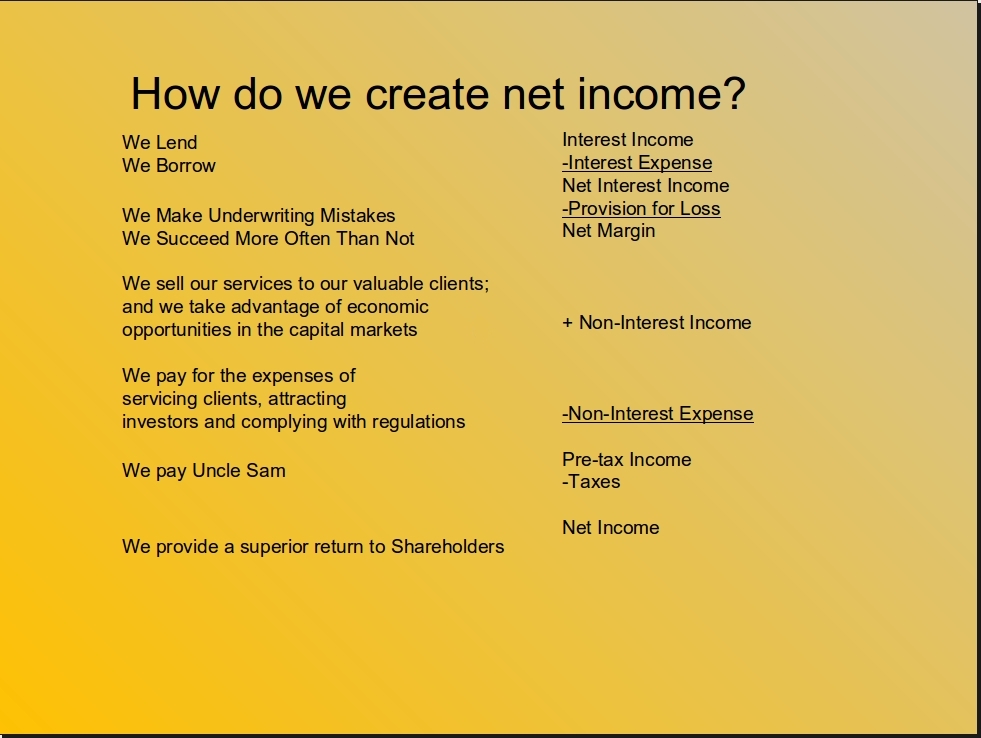

Simplifying

your bank's income statement and balance sheet so they can be easily

communicated to employees is the first step. An example is

presented below:

Here's what your employees will appreciate understanding: The bank rents money to customers (loans) and gets a rental fee from it. It also serves as a parking spot for clients' money (deposits), and it pays a parking fee for the use of the money. Interest-free checking accounts have no fee associated with them, which is what makes them most profitable for the bank. The difference between the two numbers is our margin. This part accounts for about 80% of most community bank's income.

We also charge fees for the services we provide, and those account for 20% of our income. The greater this amount, the less capital we need to have in order to operate the bank.

The rest is self explanatory.

I further believe that employees can readily understand that all bank capital, whether you're private or public, is allocated heartlessly, based upon returns. Further, capital markets raise their expectations for returns every year, which explains why banks must expect greater results from their own employees every day. It's not executive management's whim that bring them to ask for more each year; it's their own boss, the board, as a representative of the shareholder(s), which is the reason why the bar gets raised annually, to ensure that the bank continues to hold on to its capital and make an attractive investment for others.

If you want your employees to consider shareholders in their decision-making, you need to give them the tools to do so. This doesn't necessarily mean pricing models, although those can be excellent reminders of the importance of products such as core deposits and Treasury management to the overall profitability of the bank. It does entail a commitment to educate your employees on how banks make money, including entry-level people in both the front and back offices, and following up on that education with periodical reporting to all team members on the bank's financial performance and their contribution to the results. Armed with that knowledge, your employees will be far more likely to limit behaviors that benefit one group and not another, from reducing rate exceptions to ensuring that customers get placed in products that are truly best for them. Optimizing performance to all three major constituencies will ensure that your people will indeed do the right thing for both customers and shareholders